China vs. Germany vs. USA: Which Laser Cleaning Machine Is Right for Your Business

“We can buy a laser from Germany or build one from China — but what does that mean when the dust, heat, and deadlines hit?” When you stand on your shop floor, the decision isn’t just about country-of-origin. It’s about which machine will live through your conditions, your adaptability, and your failures.

In many articles, you’ll find tables — “German machines are premium,” “Chinese machines are cheap,” “U.S. machines are innovative.” But no buyer ever succeeded by tables alone. What wins is contextual wisdom. In this post I want you to feel the trade-offs, walk through haunted purchase decisions, and come away with frameworks that let you judge not by national myths — but by performance in your world.

The Global Momentum That Frames this Debate

First, note that this is not a niche fight. The laser cleaning industry itself is growing fast — and the battlefield is shifting.

- The global laser cleaning market is estimated at USD ~0.78–0.80 billion in 2025, and expected to cross USD ~1.0 billion by 2030, at a CAGR of ~5.5 %. ([Mordor Intelligence][1])

- Asia-Pacific leads the adoption wave, driven by falling cost-per-watt, industrialization, and aggressive retrofitting of legacy plants. ([Mordor Intelligence][1])

- In China especially, demand is already diverse — from 300 W lasers used in mold maintenance to larger kilowatt-class systems for heavy descaling in factories. ([Guangzhi][2])

So your decision sits at a crossroads: the technology is maturing, the cost curves are shifting, and the distinction between “cheap Chinese” and “premium Western” is blurring. The question: how do you ride that wave — not get smashed by it?

Why China Machines Should Be Your First Consideration (if You Do It Carefully)

Let me be clear: I’m not claiming “Chinese machines are always better.” I am saying: for a broad swath of real industrial use cases, starting with China as your default makes sense — if you pair it with strong vetting, safeguards, and local support.

Here’s what China brings — and what you must earn to access.

What China Brings to the Table

- Cost-Efficiency at Scale Many Chinese vendors produce in volume. The supply chain for fiber, optics, controllers, metal frames is dense. That means for a given specification (300 W, 500 W, etc.), the delta between “featureful” and “barebones” is slimmer. You pay less for what you get.

- Customization and Rapid Response Many Chinese firms are open to customizing scanning heads, adjusting optical paths, modifying I/O or software. If your parts are unconventional, you can often get “made-to-fit” adjustments.

- Ecosystem of Parts & Spares In Asia especially, spare mirrors, optics windows, fibers, spare modules often circulate broadly. If your machine falters, chances are you can source a part faster than waiting for a German OEM to ship across continents.

What You Must Guard Against (the “Earn Your Right” Conditions)

To make China your first — not your gamble — you must demand:

- Verified optics & beam path transparency (number of mirrors, alignment tolerances, losses)

- Stability data over time (how beam drifts, calibration over 6–12 months)

- Local support & spare parts promise (service in your time zone, stock of critical modules)

- Safety, compliance & certification (laser safety ratings, interlocks, compliance with your regulatory regime)

- Rigid acceptance tests under your real parts & geometry — not just clean coupons

The difference between a Chinese machine that performs and one that fails is often in how (and whether) you enforced those checks.

Where German Machines Still Hold Real Advantage (Despite Their Premium)

German engineering isn’t a myth — it has real strengths. But the premium you pay must correspond to use cases where those strengths matter.

Strengths That German Machines Bring

- Opto-mechanical stability and robustness German machines are often built as precision instruments. Their mirror mounts, structural supports, thermal compensation, and material selections are designed for long-term drift resistance.

- Brand and audit trust In regulated industries (aerospace, medical, defense), “German OEM” can lend validity. If procurement or governance processes value “trusted origin,” that gives German machines leverage.

- Seamless factory integration German industrial machinery sits often within deep automation architectures (Siemens PLCs, Industry 4.0, robotics). Their laser cleaning machines may plug more naturally into that ecosystem.

But these advantages come at a price. When machine spec differences are marginal, the cost premium may not pay off for routine industrial cleaning.

Where U.S. Solutions Matter — Not Just for Patriotism

U.S. firms often shine in niche or innovation edges. Their value is less in price than in pushing boundaries or being regionally central to your market.

What U.S. Machines Can Offer

- High-end R&D & adaptive control Some U.S. designers lead in sensor fusion, adaptive feedback, dynamic scanning, intelligent diagnostics. If your parts demand “smart cleaning” or real-time parameter adaptation, U.S. solutions may lead.

- Domestic regulatory and service alignment (for U.S. customers) For businesses in the U.S., buying from American firms can simplify warranty, safety regulation alignment, service visits, and procurement comfort.

- Brand leverage in sensitive sectors Some high-stakes sectors prefer U.S.-branded systems to minimize “import risk” or for supply chain assurances.

Again, though—these are niche advantages, not default ones.

Heart vs. Head: Stories That Illustrate the Trade-Offs

Let me share two real (but anonymized) stories from shops I advised, where the “country origin” decision turned into real pain or opportunity.

Story A: The Mold Shop That Picked German But Begged for Chinese Backup

A mold shop specializing in injection molds bought a premium German laser cleaning machine. On paper, it had superb stability, optics, safety, controls. But as their job mix changed, their cycles shortened, clients demanded faster turnaround, and the German OEM’s lead time for even a small spare mirror stretched weeks. The operators began improvising workarounds, sometimes reverting to old blasting or chemical methods during downtime.

Within a year, they purchased a Chinese backup machine. That Chinese unit—though lower spec—became their go-to when flexibility and speed mattered. The German machine stayed as the “benchmark” but wasn’t the workhorse it was meant to be.

Story B: The Startup That Bet on Chinese Innovation

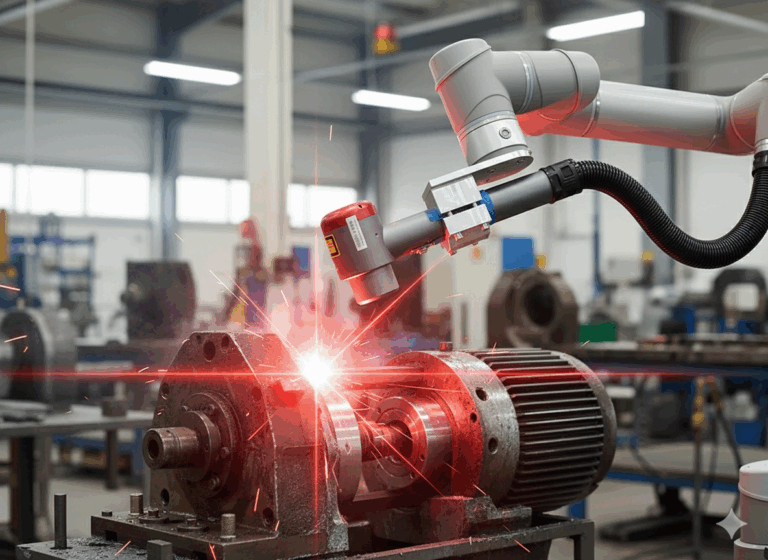

A small electric vehicle repair startup needed cleaning solutions to refurbish motor housings, brake components, and chassis elements. They wanted a laser cleaner, but couldn’t afford a “brand name” German or U.S. option. They ordered a 500 W Chinese pulsed fiber cleaning machine, demanded full beam reports, ran acceptance tests, and locked in spare parts stocks.

Over two years, the machine held up, cleaned thousands of parts, had manageable drift, and cost much less than a premium. Because they had “left budget slack”—the savings let them invest in robotics, vision, and automation on top of the cleaner. The result: they outpaced competitors who bought premium cleaners but had no room to invest further.

A Deep Decision Framework (Not Just Rules, But Judgment)

Here’s the mindset I now teach to procurement, engineering, or operations leaders—because it embeds depth, humility, and future orientation.

- Map your true tolerance for error, drift, mis-clean How many parts per million (ppm) can tolerate slight under-cleaning or overshoot? That tolerance informs how much “premium margin” you should buy.

- Define “survivable failure modes” If optics fog, beam path shifts, cooling underperforms—how degraded is still acceptable? The machine you choose must degrade gracefully within that envelope.

- Plan for evolution, not one-shot perfection Today you need 500 W pulsed cleaning. Tomorrow, you may need to add 1,000 W modules or adaptive scanning, or integrate into robot arms. Choose architectures that let you upgrade, not overthrow.

- Stress-test under your worst ambient and dust conditions A machine is only as good as in your heat, your dust, your downtime schedule, your operator skill.

- Allocate budget not just to hardware but to maintenance, calibration, optics, support The “commodity delta” you save on buying a Chinese machine can be reinvested in better calibration regimes, spare optics, monitoring systems—yielding overall better uptime.

- Build a margin of ambiguity Assume models, specs, vendor claims will be optimistic by 10–20%. Your decision must survive those deviations.

- Trust but verify Always demand real-part trials, horizon forecasts, vendor warranties, spare part assurances, and in-field feedback. The country of origin becomes only one lens in your evaluation.

Talk to Bogong Laser Cleaning Machines ExpertsGet a Quote or Customized Solution for Your Application

-

Whatsapp: +86-15665870861

-

Email: info@bogongcnc.com